Other public sector financing

China

China markedly reduced its commitments, reflecting the debt sustainability challenges faced by many African countries.

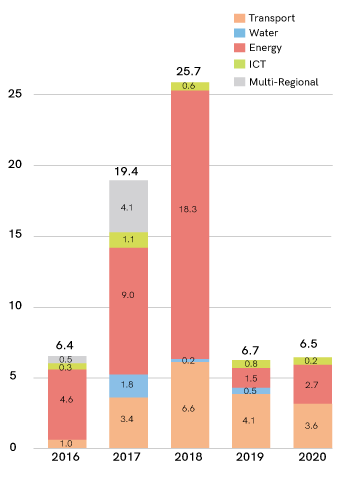

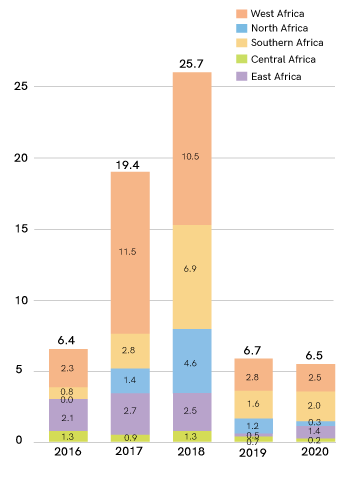

China’s commitments to African infrastructure amounted to $6.7bn in 2019 and $6.5bn in 2020. This is substantially less than the $25.7bn reported as commitments in 2018 but in line with the Chinese Government’s stated intention to reduce investments in Africa, and particularly in infrastructure, considering the debt position of several African countries. Past commitments from China have fluctuated considerably, going, for example, from $3.1bn in 2014 to $20.9bn in 2015 and down to $5.9bn in 2016. These year-to- year changes can be explained in part by Chinese funding of several very large projects the timing of which depends on country needs and where multiple large commitments can occur in the same year. At the same time various data sources define commitments in different ways complicating the identification of the year of attribution.

The largest share of Chinese financing was for the transport sector, which accounted for 60% ($4.1bn) of total 2019 commitments and 55% ($3.6bn) of total 2020 commitments, a substantial increase over the 26% (($6.6bn) of the 2018 commitments.

This reflects a major shift in sectoral priorities from the energy to the transport sector, as will be observed in the section below which provides information on commitments in the energy sector. In 2019, China committed $1.2bn to finance a 68km light rail system from an industrial city on the outskirts of Cairo, Egypt, to the new administrative capital.

Commitments of $461 million will finance the tracks, stations, communications, and other infrastructure while commitments of $739 million will finance trains. A notable 2020 commitment was the $550m loan to Zambia for the development of the Lower Kafue Gorge Hydropower Station, the first hydropower station invested and developed by Zambia in 40 years. This plant has a designed installed capacity of 750,000 kilowatts and will lift Zambia’s existing power generation capacity by 38%, helping meet the country’s electricity demand in the coming decade and provide stable power for mining and agricultural development.

The energy sector accounted for 22% ($1.5bn) of total 2019 commitments and 42% ($2.7bn) of total 2020 commitments, a substantial decrease compared to the 71% share ($18.3bn) of the 2018 commitments. In 2019, China committed a loan of $286m for the 112MW Gribo-Popoli hydro project on the Sassandra River in Côte d’Ivoire. This project will increase the share of hydroelectric power generation by 112MW and provide 580GWh of annual output.

Commitments to the ICT sector have fluctuated widely over the last few years but remained overall low. They totaled $776m (12% of total 2019 commitments) in 2019 and $180m (3% of total 2020 commitments) in 2020, compared with $550m in 2018 (2% of total 2018 commitments).

The water and sanitation sector received two commitments totaling $390m in 2019 (6% of total commitments). There were no commitments in this sector in 2020. In 2019, China committed $106m in support of the Sumbe City, Kwanza Sul Province, Integrated Infrastructure Project in Angola. The project involves slope stabilization and relocation activities, and construction works, including water drainage, footpaths, street paving, and lighting and sanitation systems.

Chinese Commitments by Sector ($m), 2016-2020

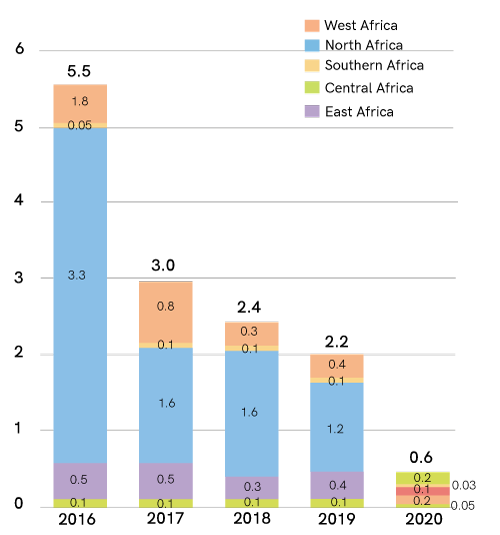

Chinese Commitments by Region ($m), 2016-2020

Arab Coordination Group (ACG)

IsDB became an ICA member in 2019. Its contributions are therefore no longer included in the group of Other Public Sources, which accounts for some of the reduction in commitments.

The Arab Coordination Group’s main purpose is to optimize the application of resources and the giving of aid by the various Arab Development Funds. A further objective is to derive benefit from coordinating financing efforts and the accompanying procedures, particularly for major projects and programs that exceed the capacity of any single institution. In addition to achieving these common objectives, the intention is to establish clear links to promote development assistance and economic relations in the recipient countries.

ACG currently consists of eleven institutions, five of which are national institutions including the Abu Dhabi Fund for Development (ADFD), the Kuwait Fund for Arab Economic Development (KFAED), the

Qatar Fund For Development (QDF), the Saudi Fund for Development (SFD), and the Iraqi Fund for External Development (IFED), and six regional organizations consisting of the Arab Bank for Economic Development in Africa (BADEA), the Arab Fund for Economic and Social Development (AFESD), the Arab Gulf Program for Development (AGFUND), the Arab Monetary Fund (AMF), the Islamic Development Bank (IsDB), and the OPEC Fund for International Development (OFID).

IsDB is now an ICA member, and its contributions are covered in the previous chapter.

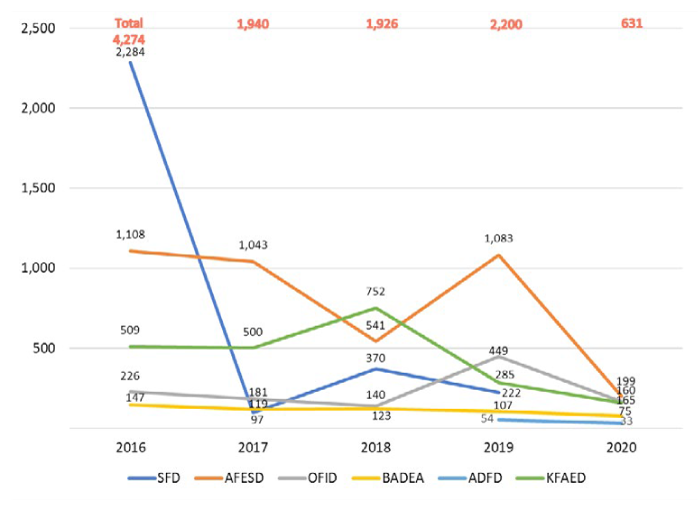

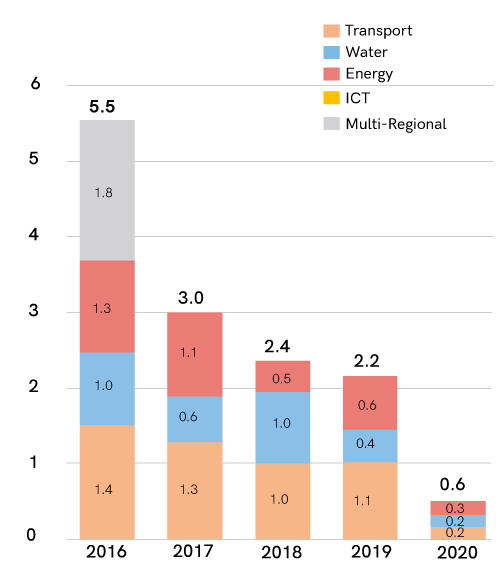

ACG non-ICA members committed $2.2bn in 2019, markedly more than the $1.3bn committed in 2018 and the $1.8bn committed in 2017. They also committed $631m in 2020

Non-ICA Member ACG Commitments by Member ($m), 2016-2020

The Saudi Fund for Development (SFD)

SFD committed $222m in 2019 for six infrastructure operations: one in water supply and sanitation: a $61m loan to Tunisia for the protection of cities and urban areas from flood. The other five operations are in the transport sector: (i) in Niger ($20m), the rehabilitation of the Loga-Doutchi Road; (ii) in Ethiopia ($75m), the rehabilitation and upgrading of the “Debre Markos-Motta” Road; (iii) in Burundi ($6m), an additional loan for the Bujumbura-Nyamatinga Road; (iv) in Gambia ($11m) for the construction of a VIP lounge at the Banjul International Airport; and (v) in Gambia, ($50m) a loan to improve roads in the Greater Banjul Area.

No information was available for 2020 commitments by SFD.

The Arab Fund for Economic and Social Development (the Arab Fund, AFESD)

AFESD committed $1.1bn in 2019 in support of six operations. This is double the $541m committed in 2018, and in line with the $1bn committed in 2017. Three transport loans ($540m) accounted for 50% of total 2019 commitments: $171m to Mauritania for a Mali border road project to contribute to the development of transport services on the main road network in the country; and $369m for two loans to Morocco for the construction of the Laayoune bypass expressway and the development of motorways. A water and sanitation loan ($247m) to Egypt aims at the establishment of a water system for the Bahr El Bakar Drain. Two energy loans ($296m) support the heightening of the Mohammed V dam in Morocco, and the construction of a 500kV transmission ring around Khartoum in Sudan.

In 2020, the Arab Fund committed $199m in support of one operation in energy in Djibouti ($98m) for the expansion and development of the Damerjog Power Plant, and two operations in water and sanitation in Mauritania, for a total of $101m, for the supply of drinking water to the Region of Aftout Elcharghi and the strengthening of the drinking water supply to the city of Nouadhibou.

The Kuwait Fund for Arab Economic Development (the Kuwait Fund, KFAED)

KFAED committed $285m in 2019 in support of nine operations. This is markedly less than the $752m it committed in 2018 and the $500m it committed in 2017. The six transport loans ($229m) represented 80% of commitments for that year. There were also three water and sanitation loans. Among the transport operations were two loans (both second loans) to Egypt for a total of $168m for the establishment of the Sharm El- Sheikh Tunnel Road, and the construction of the Ardhi 4 road. The three water and sanitation loans ($56m) were in Benin, Sierra Leone, and Togo.

In 2020, the KFAED committed $160m in support of four operations. The $82m energy loan to Sudan aims to increase electricity generation at the Al- Foula Auxiliary Bower Station. The 3 transport loans were one each in Cameroon (construction of a portion of a road in the South), Mauritania (construction of a 150km road in the East), and Senegal (road rehabilitation).

The OPEC Fund for International Development (the OPEC Fund, OFID)

OFID committed $449m in 2019 in support of 18 operations in energy, transport, and water and sanitation, compared with $140m in 2018 and $181m in 2017. Commitments for the nine energy operations ($288m) represented 64% of total commitments for African infrastructure. Some of these supported the Temane Transmission Project in Mozambique ($36m), $40m to support Egypt’s energy security, and $45m to a private energy company in Côte d’Ivoire to develop a power plant. The OPEC Fund committed $81m in support of four transport operations, including $20m to Ghana for road construction and repair and $25m to Liberia for the upgrading of the Konia-Voinjama Road. The $80m commitments to water and sanitation operations supported, among others, $30m to DRC for the Ozone Water Supply Project, and $30m to Lesotho for the Lowlands Water Development Project in the Botha Bothe Region. The commitments also included $0.4m in grants to Chad and Ghana.

In 2020, the OPEC Fund committed $119m in support of four operations, one each in energy and transport, and 2 in water and sanitation, which, for a total of $60m, represented 51% of total 2020 commitments. One of these operations, the DRC Ozone Water Supply Project ($30m), aims to provide around 1.4 million people in western Kinshasa with clean drinking water by constructing supply infrastructure capable of producing 220,000 m3 of water per day. The $26m transport loan to Tanzania will support the upgrading of a 36 km stretch of the Kazilambwa-Chagu Road and will help ease transport constraints in in the central and western parts of the country. This will help boost agricultural and tourism activities and facilitate trade with neighboring Burundi and DRC.

The Arab Bank for Economic Development in Africa (BADEA)

BADEA committed $107m in 2019 in support of five transport operations. This is comparable to the $123m it committed in 2018 and the $97m it committed in 2017. The transport operations were: a $40m loan to Mali for the rehabilitation of a road and the construction of a bridge in the Mopti area; a $20m loan to Niger for the construction of a road in the Dosso Province; an additional loan of $7m to Burundi for the construction of a section of National Highway 5; a $20m loan to Madagascar for the construction of a bridge over the Mangoky River; and a $20m loan to Ethiopia for the upgrading of the Dila-Bole-Haro Wachu Road.

In 2020, BADEA committed $75m in support of two operations, one in energy and one in transport. The $50 million energy loan to Benin includes the supply and installation of high-tension lines, and three transmission stations. The $25m transport loan to Sierra Leone will support the construction of the Btemba-Matrojon Road.

The Abu Dhabi Fund for Development (ADFD)

ADFD committed $54m in 2019 in support of five energy and one transport operations. Three of the energy projects were grants, two to Comoros for the supply and installation of seven generators with total capacity of 12.5MW, and one to Somalia ($8m) for a solar power station. Mauritius and Burkina Faso each received a loan of $10m for renewable energy projects. Cameroon received a $15m loan in transport.

In 2020, ADFD committed $33m in support of three renewable energy operations, one each in Togo (solar power plant), Liberia (hydropower plant), and Niger (solar PV plant).

Non-ICA Member ACG Commitments by Sector ($bn), 2016-2020

Non-ICA Member ACG Commitments by Region ($bn), 2016-2020

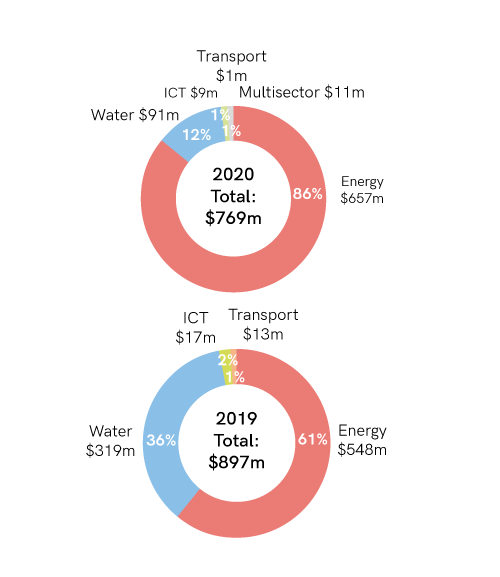

Non-ICA European Sources 2019-2020

European development organizations that are not ICA members committed $897m to African infrastructure in 2019 and $769m in 2020, compared with commitments of $1.1bn in 2018 and $1.6bn in 2017. The largest amounts supported energy operations: $548m in 2019 (61% of total commitments), and $657m in 2020 (86% of total commitments). The share of energy in 2018 was 49%. The share of water and sanitation fluctuated widely, from 36% in 2019 to 12% in 2020, compared with 19% in 2018.

Non-ICA European Commitments by Sector ($m), 2019-2020

European Bank for Reconstruction and Development (EBRD)

EBRD committed $345m in 2019, 44% less than the $744m it committed in 2018, in support of 5 operations in North Africa, the only African region in which EBRD operates: (i) an equity investment ($60m) in the Egypt Infinity Energy SAE to finance the development, construction and operation of renewable energy projects and associated ancillary business including electricity distribution and electro vehicle charging stations in Egypt and across SEMED countries; (ii) a $4.5m loan for the SPREF – Global Energy project in Egypt for the construction and operation of a 6MWp ground- mounted solar PV power plant; (iii) the Morocco Saiss and Garet water conservation ($168m) will co-finance the construction of key components of the Saiss water transfer network, and the rehabilitation and modernization of the water distribution network and full conversion to drip- fed watering system in the Garet perimeter; (iv) the Morocco Noor Midelt Solar Project ($50m) for the construction and operation of a hybrid solar plant combining photovoltaic, concentrated solar power and thermal and battery storage technologies with 800 MW of installed capacity and five hours of energy storage; and (v) the Tunisia Southern Oases Hydraulic Infrastructure project ($62m) for the modernization of the public hydraulic infrastructure serving oases of four water-scarce southern governorates.

EBRD committed $421m in 2020 for three operations: (i) the Egypt Kom Ombo project ($54m) for the construction and development of a 200 MW solar PV project. The Project will be one of the largest privately developed utility scale solar plants in Egypt and will support the country in increasing its renewable energy capacity; (ii) the Morocco Project Green Light II ($25m) to replace inefficient and polluting heavy fuel oil burners in the region; and (iii) the Tunisia STEG (Gas and Electricity Company) Liquidity and Restructuring Facility ($342m) to assist in STEG’s reforms and the development of the Tunisia’s electricity sector.

Financing by Bilateral Agencies

Seven Non-ICA European bilateral agencies committed $553m in 2019 and $347m in 2020. This compares with commitments of $290m by four agencies in 2018. In 2019 and 2020, commitments were respectively: The Netherlands: $194m and $63m; Denmark: $175m and $127m; Sweden: $93m and $91m; Norway: $60m and $35m; Finland: $15.8m and $10m; Belgium: $8.3m and $12.4m; Austria: $6.9m and $8.9m. Energy operations represented 78% of these total commitments in 2019 ($433m) and 68% in 2020 ($235m).

Regional breakdowns indicate that the largest share (45%, $246m) of 2019 commitments supported operations in East Africa, and that the largest share of 2020 commitments (36%, $126m) supported operations in West Africa. In 2020, 33% of total commitments supported multi-regional operations, compared with 10% in 2019, and 7% in 2018.

Other Sources

ECOWAS Bank for Investment and Development (EBID)

The ECOWAS Bank for Investment and Development (EBID) is the financial arm of the Economic Community of West African States (ECOWAS) comprising fifteen (15) Member States namely, Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, The Gambia, Ghana, Guinea, Guinea- Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone, and Togo. EBID) started operations in 1999 as a holding company with two specialized subsidiaries: ECOWAS Regional Development Fund (ERDF) for financing the public sector; and ECOWAS Regional Investment Bank (ERIB) for financing the private sector.

No data was available for commitments in 2019.

In 2020, EBID committed $242m, of which $146m (60%) in support of transport operations and $96m (40%) in support of energy operations. One notable commitment was the $37m loan for the rehabilitation of the 100km-long Kanawolo- Korhogo Road in Côte d’Ivoire. The objective of the project is to strengthen commercial activities along the road, and to strengthen cross-border commercial activities with neighboring Mali and Burkina Faso. In the energy sector, a $37m loan was made to Sierra Leone for a rural electrification project in seven district townships.

New Development Bank (NDB)

The New Development Bank share of financing to clients in South Africa increased from 9%of the Bank’s cumulative approvals in 2018 to 16% in 2019, and 18% in 2020.

In 2019, NDB committed $1.7bn in loans, in support of five operations in the Republic of South Africa (RSA): three in energy for a total of $989m, one in transport ($498m), and one in water supply ($228m). Two of the energy loans were to Eskom, a state-owned electricity utility that generates approximately 95% of the electricity used in the country. One of these was a $480m loan to support the retrofit of flue gas desulphurization equipment on an existing thermal power plant of Eskom. The main objective of the project is to reduce the power plant’s sulfur dioxide (SO2) emissions from the current level of 3,500 mg/m3 to below 500 mg/m3 by 2026, to comply with national environmental regulations. Another energy loan ($81.9m) went to the Industrial Development Corporation (IDC) for on-lending to renewable energy power projects, including independent power producers, which will support the country’s efforts to diversify the energy mix away from coal, shifting towards a less carbon-intensive and more resilient development trajectory.

The transport operation was to support the South African National Roads Agency SOC Ltd (SANRAL) for a program aimed at strengthening and improving the network of national toll roads. To that end, 240 lane-km of new toll roads will be constructed, while another 240 lane-km of existing key toll road sections will be rehabilitated. Auxiliary infrastructure, such as bridges, intersections, and safety measures, will also be built or upgraded.

The water supply operation supported the Trans- Caledon Tunnel Authority (TCTA), a South African government agency, for the implementation of the second phase of the Lesotho Highlands Water Project. It will finance the construction of water transfer infrastructure in Lesotho designed to augment water supply in the Vaal River Basin, home to South Africa’s most economically important province, Gauteng. The project aims to support economic growth and foster sustainable livelihoods of people by increasing water yield of the Vaal River System by almost 15%, thus reducing the need for water usage restrictions, and promoting South Africa’s resilience to drought.

In 2020, NDB committed a $1bn sovereign loan in support of South Africa’s Non-Toll Roads Management Program, which aims at maintaining and improving critical road infrastructure, thus contributing to lower transportation costs and increase the competitiveness of the economy.

Asian Infrastructure Investment Bank (AIIB)

In 2019, the Asian Infrastructure Investment Bank (AIIB) approved a $150m loan to the National Bank of Egypt (NBE) for on-lending to sub-projects in the infrastructure sector. The funding supports the Government of Egypt’s initiatives to increase investments into infrastructure.

There were no approvals for infrastructure in Africa in 2020 by AIIB.

Africa50

Africa50 is an infrastructure investment platform that contributes to Africa’s growth by developing and investing in bankable projects, catalyzing public sector capital, and mobilizing private sector funding Africa50’s investor base is currently composed of 28 African countries, the African Development Bank, the Central Bank of West African States (BCEAO), and Bank Al-Maghrib, with over $876m in committed capital.

In 2019, Africa50 participated in three operations: the Egypt Scatec Solar Power Plants, the Senegal Tobene Power Plant, and the Madagascar Volobe Hydropower Plant. The Egypt Scatec operation is a 400MW DC portfolio of six utility scale solar power plants located at the Benban site. The plants are expected to contribute to reducing dependence on imported oil and gas, thereby improving the country’s energy security.

The operation provides flexible grid-stabilizing baseload generation capacity at competitive tariffs, which helps close the electricity supply gap in Senegal. The 120MW Madagascar Volobe hydropower plant will be operated under a 35-year concession. The project includes the construction of a transmission line, refurbishment of the access road, and infrastructure for the neighboring villages.

In 2020, Africa50 acquired a 33% equity stake in Société de Gestion de l’Aéroport de Gbessia (SOGEAG), the airport Conakry Guinea concessionaire, for the upgrade and extension of the airport. The project includes the design, structuring, construction, and operation of new passenger and cargo terminals and related infrastructure, including aprons, parking areas and taxiways.

India

India committed $803m in 2019 and $1.3bn in 2020. These commitments included a $750m guarantee in 2019 for ICT to Network I2I Limited, a major Mauritius-based, wholly owned subsidiary of Indian Bharti Airtel. In 2020, Network I2I also received commitments of $1.2bn, a combination of guarantees, equity, and loans.

India’s 2019 commitments also included $53m of loans, equity, and guarantees for several operations in Mauritius in transport and energy, and $3m in loans and equity in support of operations in Ghana, Côte d’Ivoire, Kenya, and Tanzania. The 2020 commitments also included $92m of guarantees, loans, and equity in support of transport and energy operations in Mauritius.